” Just how can a low price on cars and truck insurance policy misbehave?”

” Automobile insurance policy is vehicle insurance, right? – If I am comparing $80/month at Insurance firm 1 as well as $70/month at Insurer 2 – why would certainly I ever intend to pay the higher quantity?”

” Why should I understand those bothersome numbers?”

All legitimate inquiries – although, if you have ever before found yourself asking (or a version of them) you must be downright terrified, and also worried that you do not recognize how your automobile insurance policy functions.

Among the most dangerous settings in this life to find yourself in is one where find out far too late that you “didn’t know something that you thought you understood” or you “really did not understand something that the legislation or ‘status quo’ thinks you need to recognize”.

Let’s envision …

You are driving along, as you do every day, heading to work and being the incredibly diligent chauffeur you know on your own to be. You are NOT putting your cosmetics on; You are NOT speaking on your cell phone; You are NOT adjusting the radio; You are, as a matter of fact, paying attention to the road as well as your environment.

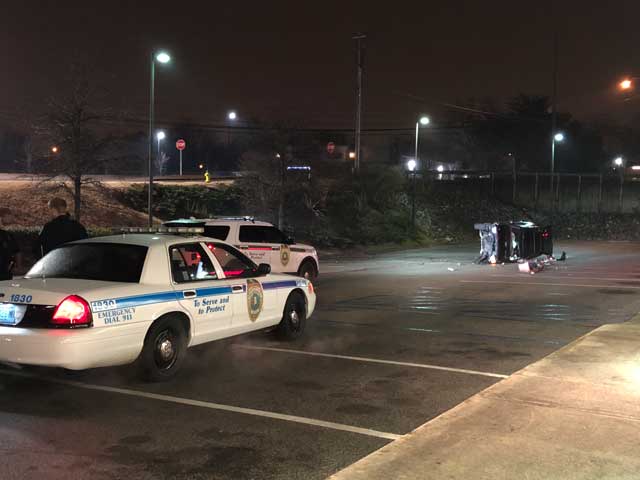

While speaking with the authorities on the side of the roadway, you define the event:

Somebody pulled out into the best lane from a car park setting about 30MPH, compelling the automobile already there to cross into my lane in front of me, for one reason or another, instantly after entering my lane they slammed on their brakes and I struck them!

Now, I am no policeman, nor do I play one on television, but my assumption is the accident as explained is your mistake. Thankfully, in our example, no one is seriously harmed during the mishap. This write-up allows confessing that, while driving, points can happen really rapidly, and through no obvious fault of our very own, we can be discovered lawfully “to blame” due to some other person’s mistake.

What Do The Numbers Mean and Why Should I Recognize Them?

In Texas, the State minimum called for coverage to show economic responsibility is 20/40/15. We have all seen these numbers over and over once again, however, you would be surprised how many people have no concept of what they indicate.

Each number is in thousands and also is the maximum protection you would obtain – so 20 implies up to $20,000, 40 suggests approximately $40,000, as well as 15, suggests approximately $15,000. The initial number is each physical injury number in thousands. The second number is the complete bodily injury per mishap and also the last number is the quantity of property damage covered.

In our instance over, allow’s state that the individual you hit got $10,000 in physical injury. They were alone in the car as well as nobody else was hurt as a result of you hitting them. Their bodily injury would be covered due to the fact that it is less than the $20,000 maximum per person limit, and additionally under the $40,000 per accident restriction. Nonetheless, they were driving a used 2006 Honda Odyssey Mini-van (an incredibly popular design last year). This van deserves about $37,000. Now, depending on the speed you hit the van as well as the number of airbags released, let’s state the fixing bill was somewhere in the neighborhood of $18,000. Based on your protection, if you were carrying the Texas State minimum required, your insurance provider would certainly compensate to $15,000 and you would certainly be in charge of $3,000.

How can a low price on vehicle insurance misbehave?

It is imaginable that our mishap above would certainly involve more than one vehicle, or greater than a single person (in our instance above, if the lorry was a mini-van, it is most likely that there would be at least 3 travelers). On the occasion that the maximum insurance coverages you can read more info here do not cover the loss, you may receive judgments to pay whatever balances are left over after your protections have been exhausted.